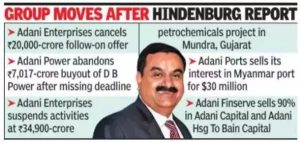

Indian billionaire Gautam Adani has decided to sell his financial services business after being in the segment for six years. His closely held company, Adani Finserve, will sell 90% of Adani Capital and Adani Housing to an American investment firm called Bain Capital. The financial services business, led by Gaurav Gupta, focuses on providing loans to small and medium-sized enterprises (MSMEs) and affordable housing loan options for rural areas.

Gaurav Gupta, who owns 10% of Adani Capital and Adani Housing, will continue to run the business under Bain’s ownership. To support its growth, Bain Capital will invest $170 million in the financial services unit. The unit’s value is approximately $250 million. It will retain the Adani name temporarily until the transition is complete. The Reserve Bank of India (RBI) needs to approve it. Avendus Capital and Rothschild are making the deal happen, set to be done by year-end.

Gautam Adani expressed his confidence in Gaurav Gupta, stating that he has not only built a successful financial services business with a focus on underserved areas but also made valuable contributions to the Adani Group. Adani believes that the partnership with Bain Capital will lead to significant growth for the business.

Billionaire Mukesh Ambani is spinning off his financial services business to list it on the stock exchange. Adani’s decision to reevaluate projects comes after Hindenburg Research questioned the company’s credibility in January. Although Adani refuted the claims, it led to a significant decline in the group’s market valuation and the withdrawal of a Rs 20,000-crore follow-on offering by Adani Enterprises.

Gaurav Gupta had planned to make the financial services unit public in 2024. He aimed to sell approximately 10% stake through an IPO. However, the plans changed, and now Bain Capital is buying the business.